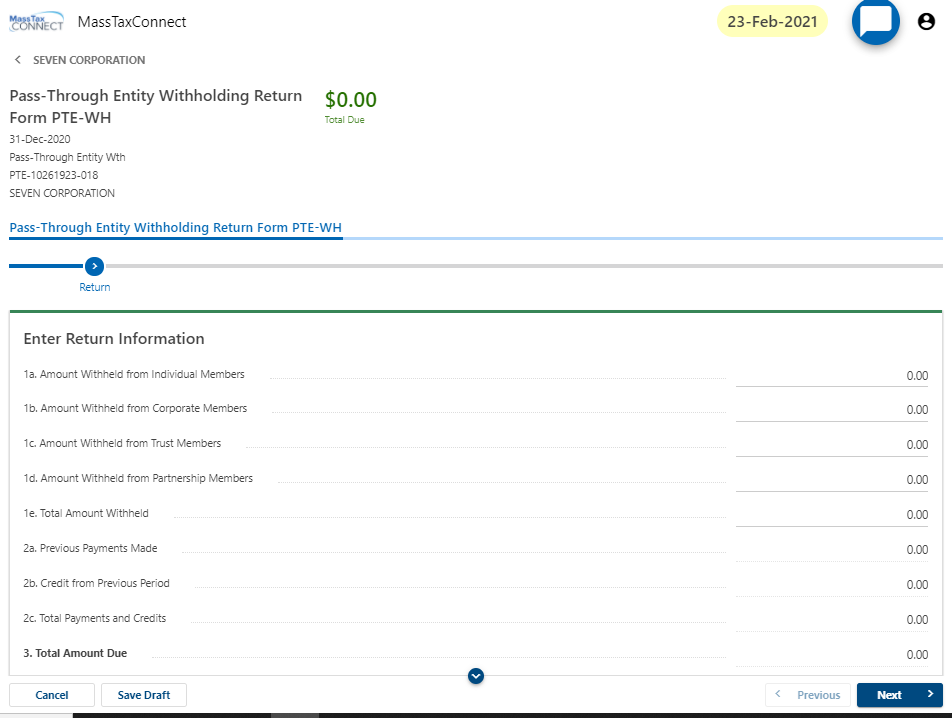

flow-through entity tax form

This legislation was passed as a. 2021 Flow-Through Entity Tax Annual Return Form Warning Save functionality for FTE returns is forthcoming in the meantime enter all return data in one session.

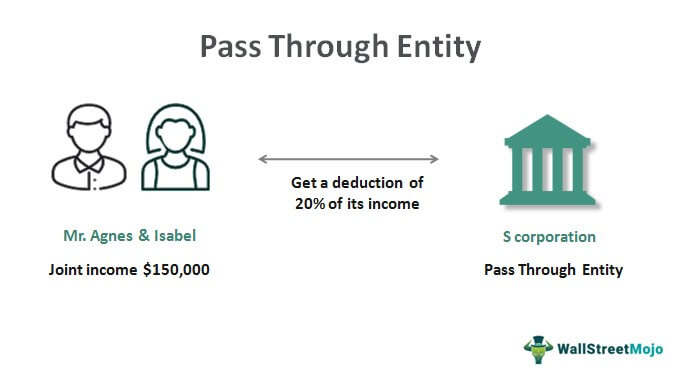

Pass Through Entity Definition Examples Advantages Disadvantages

However the late filing of 2021 FTE returns will be.

. The online application to opt in is now available and you must make an estimated payment with the. AR1155 Pass-Through Entity Extension Request. Flow-throughs are also a growing tax compliance concern.

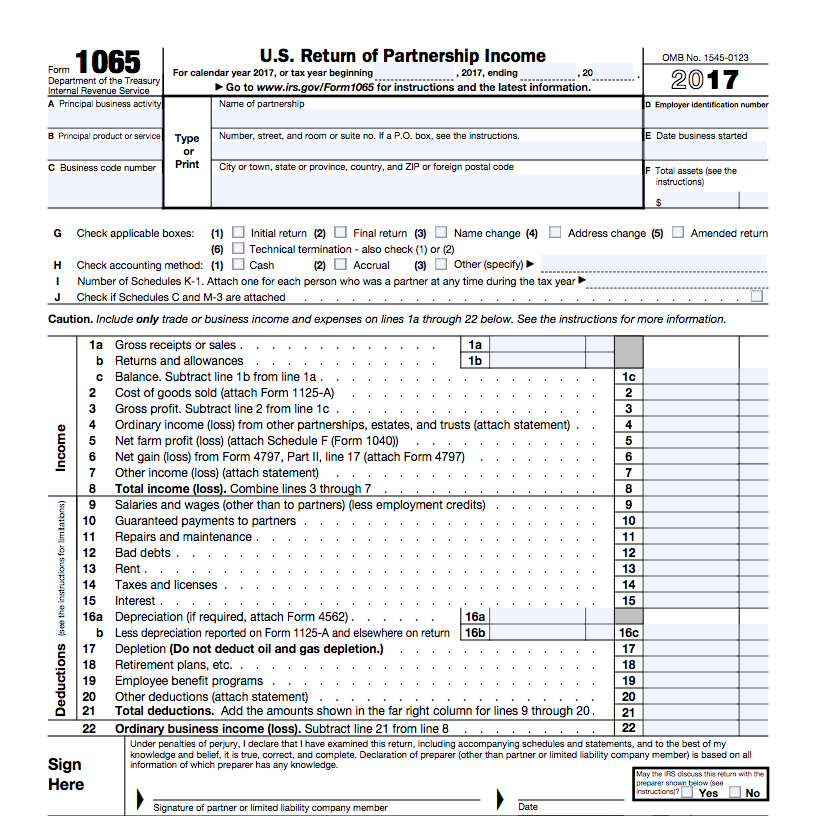

Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. The flow-through entity tax annual return is required to be filed by the last day of the third month after the end of the taxpayers tax year. AR1100ES PET Pass-Through Entity Estimated Tax Vouchers.

This guidance is expected to be published in early January 2022 and will be posted to the Departments website. The continued levy of the tax is contingent upon the existence of the federal state and local tax. The following are all pass-through entities.

Governor Whitmer signed HB. AR1100PTV Pass-Through Entity Payment Voucher. There are three main types of flow-through entities.

2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. Types of flow-through entities. For further questions please contact the Business Taxes Division.

The deadline to opt in to the New York State PTET has been extended to September 15 2022. Branches for United States Tax Withholding and. Branches for United States Tax Withholding provided by a foreign.

A business owned and operated by a single individual. The Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. If you filed Form T664 Election to report a Capital Gain on Property owned at the End of February 22 1994 for any of the above shares of or interest in a flow-through entity.

2016 New York State Tax Summit Flow-through Entities and New York Allocation Flow-through Entities Characteristics Entities that pass their income gain loss deduction to their owners. One particular flow-through compliance concern is the existence of complex structures of related entities. Through entity receiving a payment from the entity I certify that the entity has obtained or will obtain documentation sufficient to establish each such intermediary or flow-through entity.

This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain. The flow-through entity tax is retroactive to tax years beginning on and after January 1 2021. A pass-through entity is an entity whose income loss deductions and credits flow through to members for Massachusetts tax purposes.

5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan. For calendar filers that date.

Pass Through Entity Definition Examples Advantages Disadvantages

:max_bytes(150000):strip_icc()/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Pass Through Taxation What Small Business Owners Need To Know

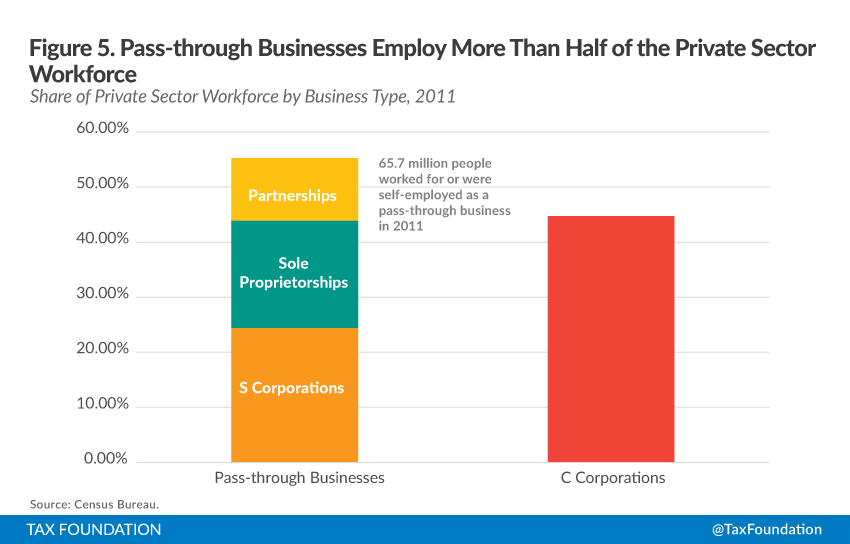

Pass Through Business Definition Taxedu Tax Foundation

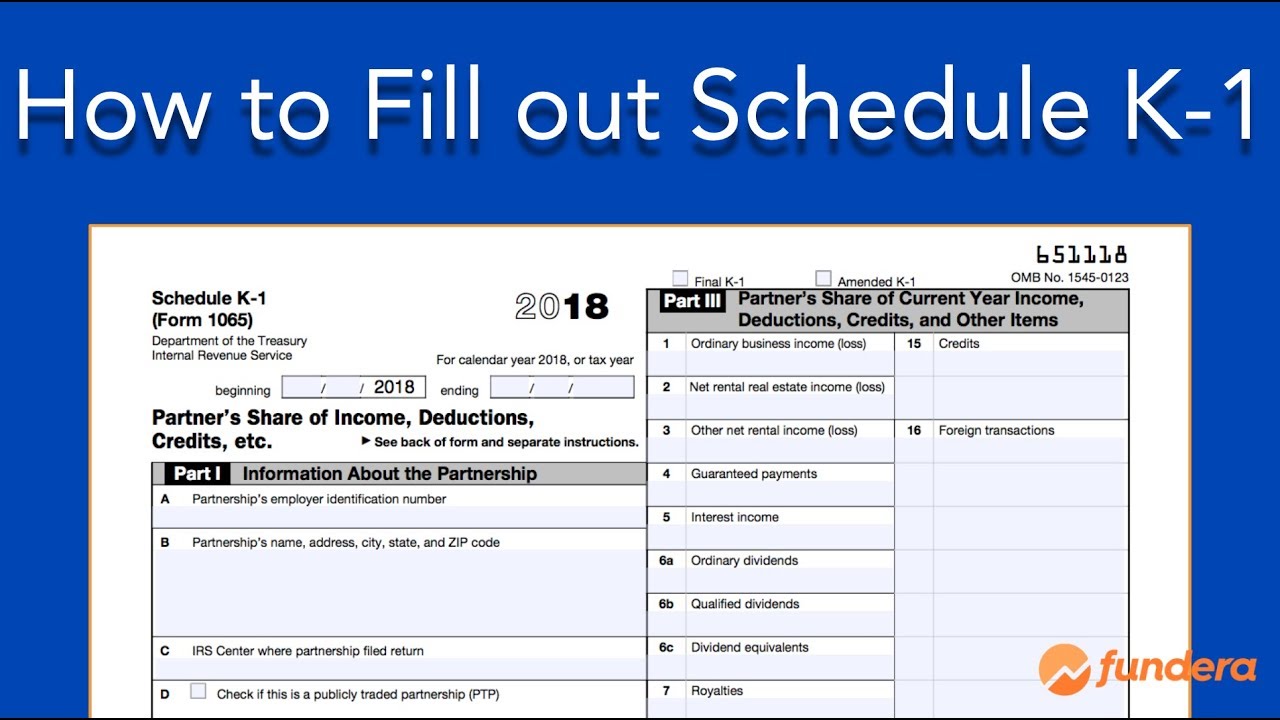

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

An Overview Of Pass Through Businesses In The United States Tax Foundation

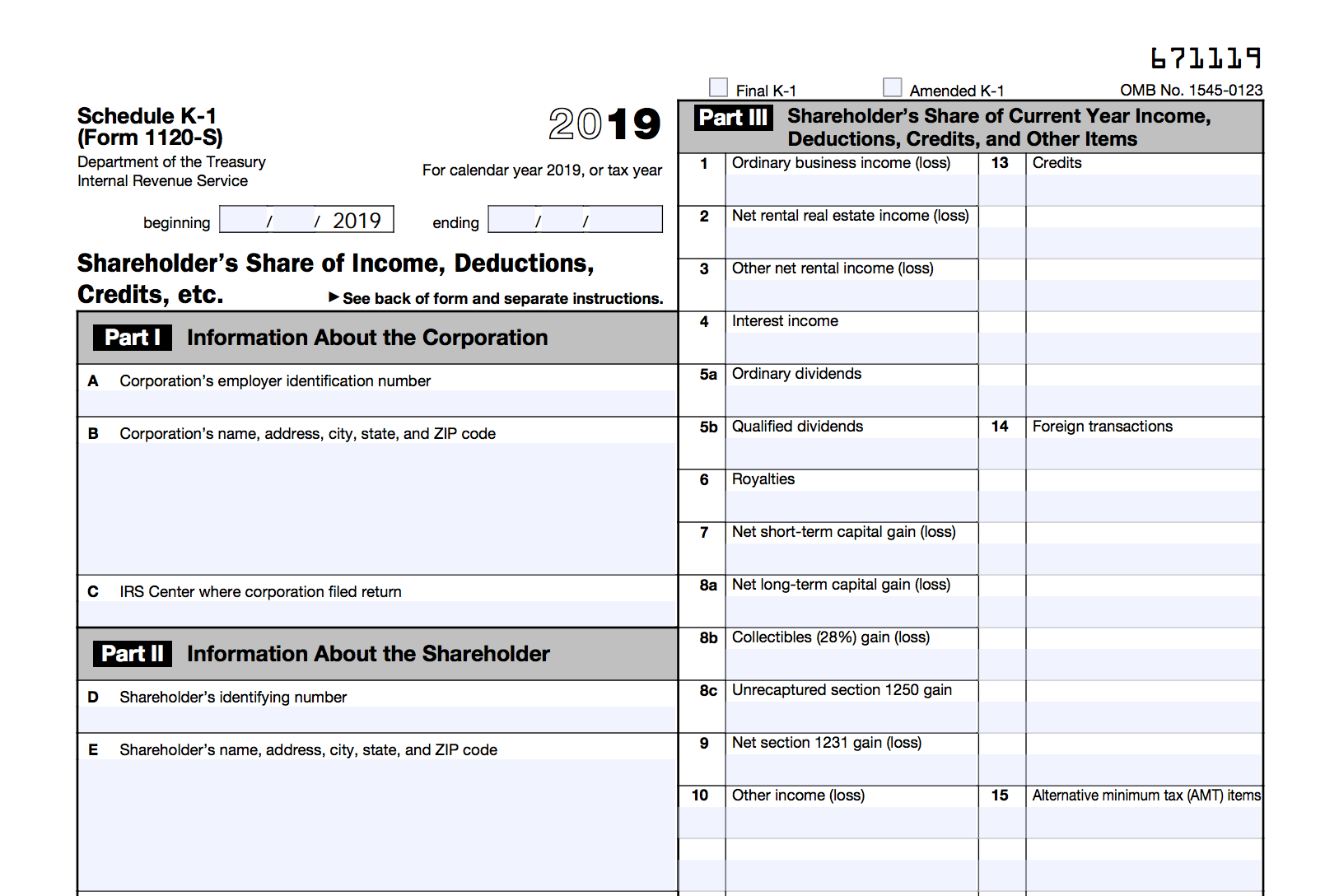

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

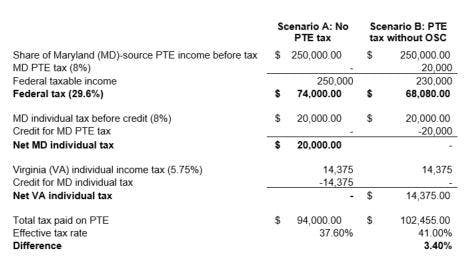

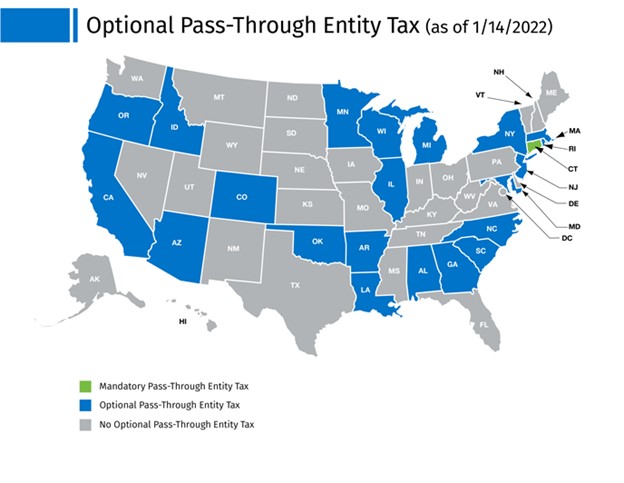

Pass Through Entity Tax 101 Baker Tilly

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

What Is Schedule C Tax Form Form 1040

An Overview Of Pass Through Businesses In The United States Tax Foundation

Elective Pass Through Entity Tax Wolters Kluwer

Considerations For Filing Composite Tax Returns

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits